2026 Budget Consultation

This consultation has closed. Thank you to everyone who participated.

What we heard: On November 18, 2025, City of Port Moody staff presented a report with consultation results at Finance Committee. Watch the video recording of the meeting and/or review the report and consultation results in the on-table agenda package, item 4.1, pages 9-75). Council will consider this information prior to approval of the Provisional 2026-2030 Financial Plan in January 2026. Final approval of the budget will take place in April 2026 after the City has received the revised tax roll from BC Assessment and final information from the Province.

The budget process is about balancing the delivery of services and programs (spending) with property taxes, fees and charges, and funds from other sources (revenues) to meet the needs of the community. Your input helps Council and the City find the right balance and provide the best value for your tax dollars.

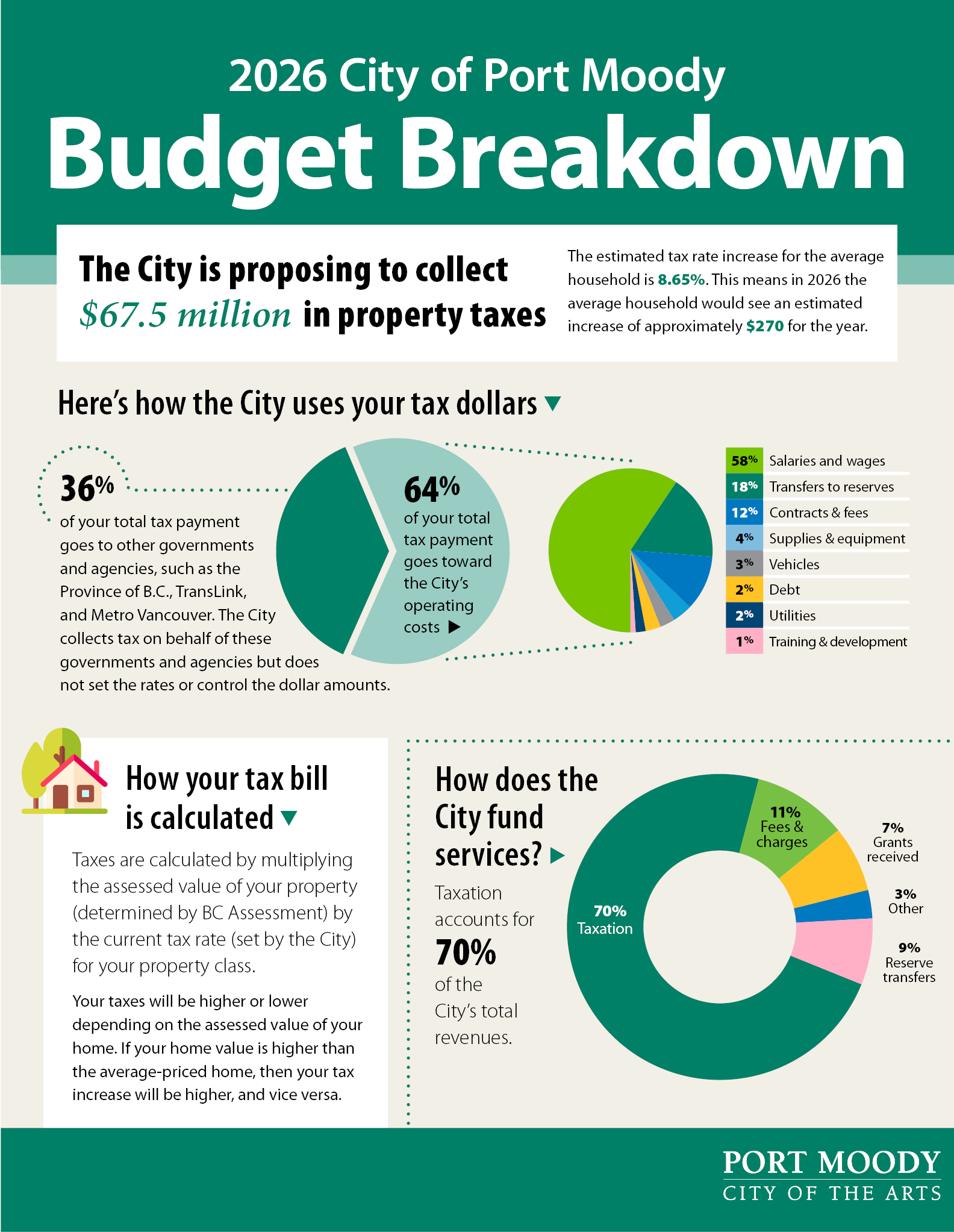

In 2026, the City is proposing to collect $67.5 million – approximately $5.67 million more than in 2025 – in property taxes from residents and businesses to balance the budget. The estimated tax rate increase for the average household is currently being proposed at 8.65 per cent. This means in 2026 the average household would see an estimated increase of approximately $270 for the year – that’s $5.19 per week or $0.74 per day. The increase for each individual household will depend on the value of your property, as assessed by BC Assessment, and your change in assessed value relative to the average change in assessed value for all other households.

Learn more

Here are some resources to explore:

- review our proposed budget breakdown to learn more about the proposed tax rate increase and to find out what it would cost an average household to run the City in 2026

- read our budget guide (PDF) with information about the budget process and the City’s proposed net operating expenses for 2026

- see examples of proposed capital projects included in the Draft 2026-2030 Financial Plan

- read the full Draft 2026-2030 Financial Plan (PDF)

- review our frequently asked questions or ask a new question

- watch our video to understand how your property taxes are calculated

- view the 2026 budget schedule with links to City Council presentations and meeting videos from the budget planning process

Next steps

A summary of public engagement results was presented to Council for their consideration on November 18, 2025, prior to approval of the Provisional 2026-2030 Financial Plan, scheduled to happen in January 2026. Staff and Council will also consider information collected as part of the 2024 Community Satisfaction Survey, conducted by Ipsos, in budget workshops and deliberations. Final approval of the budget will take place in April 2026 after the City has received the revised tax roll from BC Assessment and final information from the Province. Municipalities must set their property tax rates by bylaw before May 15 of each year.