2026 proposed budget breakdown

How much is the City proposing to collect?

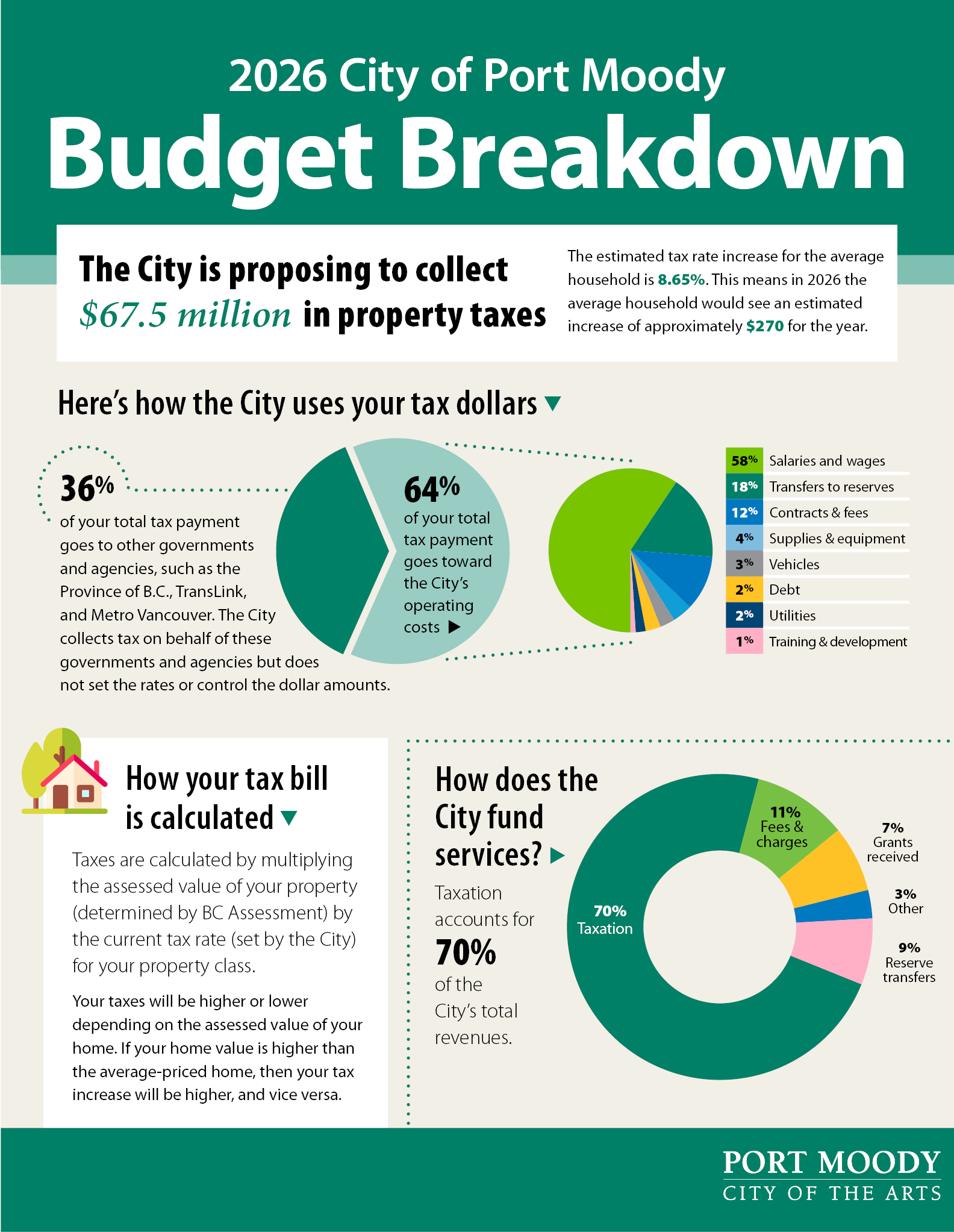

In 2026, the City is proposing to collect $67.5 million – approximately $5.67 million more than in 2025 – in property taxes from residents and businesses to balance the budget. The estimated tax rate increase for the average household is currently being proposed at 8.65 per cent. This means in 2026 the average household would see an estimated increase of approximately $270 for the year – that’s $5.19 per week or $0.74 per day. “Average household” refers to a Port Moody residential property assessed by BC Assessment at the preliminary 2025 average amount of $1,291,000. The increase for each individual household will depend on the value of your property, as assessed by BC Assessment, and your change in assessed value relative to the average change in assessed value for all other households.

Why is the City proposing to collect more than last year?

The City is proposing to collect more in property taxes this year to cover rising costs related to factors such as: labour costs including salaries and wages; employee benefits; insurance; and replacement of existing critical infrastructure, amenities, and facilities.

Click the image below to view a larger version.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends